Payroll register calculator

Payroll Table 2022 Contracts Active Multi-Year Summary Positional Spending Prospects The Future Free Agents 2023 Player Option. Payroll Table 2022 Contracts Active Multi-Year Summary Positional Spending Prospects The Future Free Agents 2023 Player Option.

Payroll Calculator Free Employee Payroll Template For Excel

Clear Calculate Next Free Payroll Calculator.

. The payroll calculator worksheet helps you with calculating the employee payroll based upon regular hours sick leave hours and. The calculator is set for full-time employees and is meant for general information. If you would like to see each step in detail check out the step-by-step guide that we created just for you.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Choose Tax Year and State. Our calculator can help you do most of the heavy lifting but here are some additional resources and contact information you may need to start running payroll in New York.

Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy. Governance and administration of public service pension schemes. WorkForce West Virginia Local Offices Register Your Business.

As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. A payroll register template and payroll calculator template.

2022 payroll calculator for the Czech Republic. New Jersey Payroll Tax Rates. Washington Payroll Tax Rates.

It does not take into account the maximum assessment basis for social security contributions which is monitored on an annual basis. Open a business bank account. New York Department of Taxation Finance withholding assistance.

Minimum yearly repayment required on a loan. Federal Payroll Taxes. Register as an Employer with the Department of Revenue.

But instead of integrating that into a general. Accountants bookkeepers payroll administrators. Additional NY Payroll Tax Resources.

This payroll template contains several worksheets each of which are intended for performing the specific function. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use. In case that wasnt enough here are some more resources for you to learn more about New Jersey payroll taxes.

Below is a quick 6-step overview of everything that goes into calculating the payroll tax for your employees. Register to save paychecks and manage payroll the first 3 months are free. Employer Tax Information with the Employment Security Department.

Use the Division 7A calculator and decision tool. Free New Jersey Payroll Tax Calculator and New Jersey Tax Rates. Payroll Journal Payroll Register Employees W2 and 109910981096 forms.

Tax Year for. To figure out your California payroll withholding and federal payroll taxes just enter wage and W-4 allowances for each employee below. How to use Free Calculator.

28846 per week from 1 January 2019 11538 per week up to 31 December 2018. Use free or paid Paycheck Calculator app and precise Payroll Guru app to calculate employees payroll check in the residence state. Check out your states payroll taxes below.

Accountants bookkeepers and financial institutions in Canada rely on us for payroll expertise and payroll services for their clientele. 103 KAR 18150 To register and file online please visit wrapskygov. Register as an employer with the Department of the Treasury 609 292-9292.

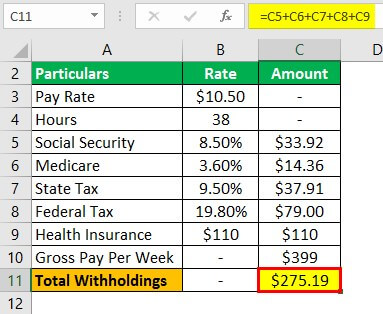

Apply for licenses and permits. Amount of the loan not repaid by the end of an income year closing balance. You can use the payroll calculator sheet as a pay stub showing tax withholdings and other deductions gross.

For workers and members of the public saving into a pension. West Virginia State Tax Department 800 982-8297 Withholding Tax Tax Calendar. Figuring out how to pay employees can be a huge hassle but our payroll calculator simplifies the process so you can spend more time focusing on making your small business the best it can be.

More West Virginia Payroll Tax Resources. Hire and manage employees. Tax Year for Federal W-4 Information.

2022 Employer Withholding Tax Calculator. Free Washington Payroll Tax Calculator and WA Tax Rates. Sage Tax Calculator Try our easy-to-use income tax calculator aligned to the latest Budget Speech announcements.

First and foremost lets walk through a summary of federal payroll taxes that all of your employees have to pay no matter which state they live in. Our handy payroll calculator can help you figure out the federal payroll tax withholding for both your employees and your business. Interest payable to the lender for the income year.

Independent trustee register Professional trustee standards. Sage Business Cloud Adviser Portal Providing you with the tools to become a trusted Partner. Trusted by thousands of businesses PaymentEvolution is Canadas largest and most loved cloud payroll and payments service.

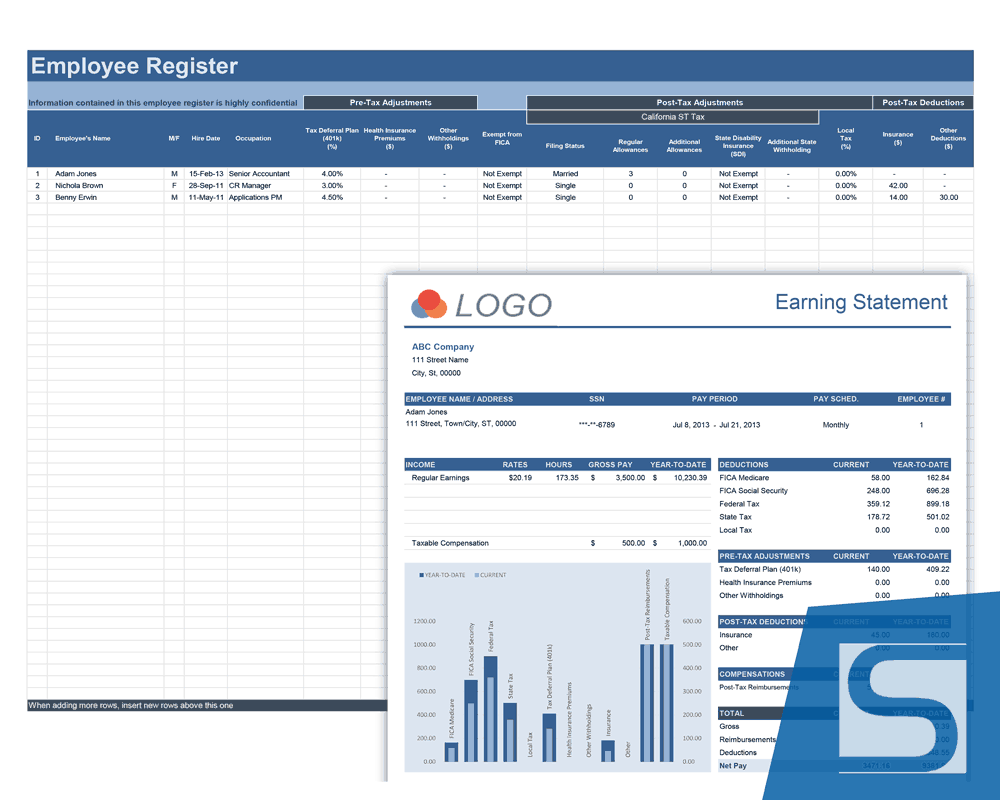

Filing Status Children under Age 17 qualify for child tax credit. Get federal and state tax ID numbers. Use the register to track employee information such as salary pay schedule vacation hours exemption status deductions and more.

Digital Tools Sage has put together key business resources to assist and enable you in the successful running of your business. As if that wasnt enough here are some helpful links that can if you would like to learn more about West Virginia payroll taxes. How to register for VAT in the Czech Republic.

First and foremost we have to take care of Uncle Sam. Understand your role as a pension scheme trustee. An employer or a member of a group of employers who in any month pays wages which are liable to payroll tax in South Australia must register for payroll tax when the Australian taxable wages of the employer or group exceeds.

I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Calculate net paycheck federal taxes payroll withholdings including SDI and SUI payroll state taxes with ease and on the.

The first worksheet is the employee register intended for storing detailed information about each of your employees. If you have a complying loan agreement in place this component will calculate the. 518 485-6654 Register for Withholding Taxes.

Choose Tax Year and State. Register a New Account. This download offers two templates in one.

Buy assets and equipment. Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. Register to save paychecks and manage payroll the first 3 months are free.

2021 Withholding Statement Reporting Withholding statements include W-2 W-2G and 1099 forms. An updated look at the Colorado Rockies 2022 payroll table including base pay bonuses options tax allocations.

Payroll Calculator Free Employee Payroll Template For Excel

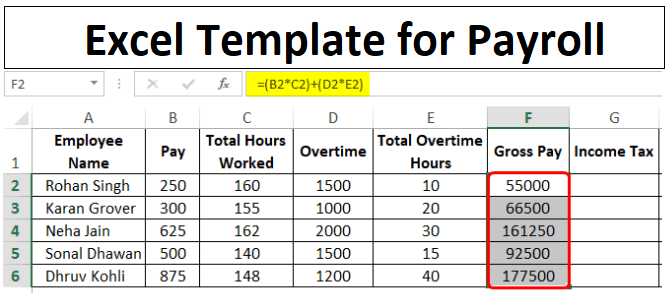

Payroll Formula Step By Step Calculation With Examples

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Sample Resume

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Template Free Employee Payroll Template For Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Excel Template For Payroll How To Create Payroll Template In Excel

10 Useful Free Payroll Templates Utemplates

15 Free Payroll Templates Smartsheet

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator Free Employee Payroll Template For Excel